In today’s post, we’ll talk about financial goals. At the end of the reading, you will be armed with the tools to start setting your financial goals clearly, and you will be heading in the right direction to achieving them.

Why do you need to set financial goals?

If you ever want to be financially independent, be rich, or retire at some point, you need to learn to manage money. Even if you think you don’t have money to manage, you will receive more of it if you learn more about what you don’t have.

You first go and find your whys. It is important that you feel motivated to achieve your goals. In my case, I know that by setting my financial goals, I will be closer to be financial independence, and that is my ultimate goal.

In fact, Some studies from the Journal of Applied Psychology show that setting collective goals increases the chances to achieve them. It must be because you are accountable for your progress and setbacks and, in a way, is an incentive to keep going.

So why not make your financial goals part of the family? Make it a subject to discuss with your significant other and plan for the future.

Where to start setting your financial goals?

Firstly there are three types of financial goals short term financial goals, middle term financial goals, and long term financial goals.

The main reason why financial goals should be broken into terms is that you don’t get overwhelmed with your long term goals. In that sense, you are more likely to achieve your goals.

In fact, it sets the foundation for the steps that you need to take to get where you want to go. Take it as your road map to financial freedom.

Short term financial goals

Firstly your short term financial goal should start with budgeting. A budget helps you control your expenses; allocate your money towards saving or paying debt, whatever your priorities are. For example, saving money for a house.

Track expenses

But before you start budgeting, you need to know what you spend each month. You have fundamentally two kinds of monthly expenses:

Fixed like rent or mortgage, car payment, whereas those you can reduce or increase each month like food cost, or entertainment are flexible.

If you bank online, your banking institution would probably offer an expense tracker app.

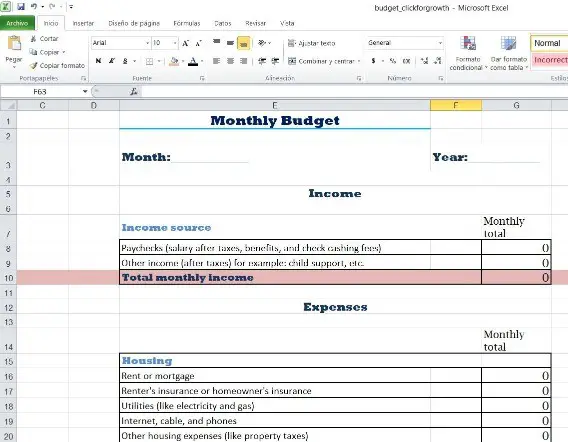

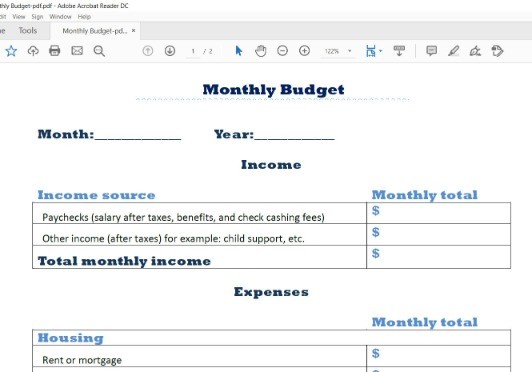

With an expense tracker, you can classify all your expenses provided you have all your accounts under the same roof. But if you don’t, take a piece of paper and start writing them down or download my free budget spreadsheet.

Creating a Budget

Now that you have tracked your monthly expenses, you are ready to set up your budget.

A budget gives control over your money since your plan will show how much you make and much you can spend.

When I tracked my expenses, I realized I was spending way too much in the dollar store. Although I used to think I was saving money, the truth is that I would go in looking for something and would go out with 15 items more than what I needed it just because I thought it was inexpensive. And dollar stores are a metaphor; nothing costs a dollar anymore.

So if I go twice a week and spend $50 each time, that’s $100 a week, times 4, that’s $400 a month on the dollar store!! See, in the end, the small bills sum up.

For your budget, you can use the software, but you really don’t need it. A spreadsheet will do the trick.

Now the order for the next step will depend on what makes sense to you. Some financial advisors recommend creating an emergency fund first, whereas others recommend paying debt first.

I personally believe that paying off debt should be your next priority. That’s what I would do.

Paying off debts

Since this is a short term goal, let’s focus on paying credit cards, line of credits, and high-interest debt. Let’s forget about a mortgage for now; by forgetting, I mean to keep paying just your monthly or whatever your frequency payments are.

I have never have had credit card debt since I always pay them in full every month. However, I have had a huge balance in my credit line of credit 30k that I use to invest in private mortgage lending.

I also won’t borrow money for any other purpose than to make money. You shouldn’t either unless you are left with any other option.

To pay my debt, any excess money we had was transferred directly to the line of credit.

There are mainly two approaches to paying off multiple debts the debt snowball and the debt avalanche.

Debt Avalanche

Budget debt avalanche, which is my preferred debt repayment plan, and it, makes more sense to me. Let’s see why.

The debt avalanche focuses on paying the highest-interest debt first while making only the minimum payment on the rest of the accounts.

Let’s analyze the following scenario:

| Debt amount | Minimum monthly payment | %Interest |

| $5000 credit card | $ 10 | 19.75% |

| $3000 Car | $200 | 1% |

| $15000 Line of credit | $63 | 5% |

By the debt avalanche approach, you will focus on paying the debt with the highest interest first. Why? Because it costs you more to keep the debt with 19, 75% interest.

If you are left with 1000 dollars after expenses to pay your debt, you will reserve $263 to pay the car and the line of credit. All the remaining $737 will go towards paying the $5000 credit card debt.

After the credit card debt is fully paid, you can start paying the next highest interest debt, in this case, the $15000 line of credit. And ending with the $3000 card debt.

This debt-paying approach takes consistency, discipline, and motivation, but it is the best way to pay off debt.

Debt snowball

On the other hand, with the debt snowball plan, you will pay off the smallest debt first, notwithstanding the interest rate.

In our previous example, you would pay the $3000 car debt first and still paying only the monthly payment on the credit cards and the line of credit.

The most significant benefit of this debt repayment method is the emotional reward you will have once you pay off your smallest debt. Giving you the momentum to keep going.

If you think you need that kind of motivation, then apply this method to pay off your debt?

You chose the plan that makes more sense to you.

You can use other options like debt consolidation or debt settlement if you are in deep money trouble. However, this can impact your credit score negatively and have many different consequences.

Create an emergency fund

We need to create an emergency fund before or after paying debts. If you have decided, like me, to focus on paying debt first, in case you find yourself in an emergency situation, borrow from the lowest interest payment option. In our example, I would borrow from the line of credit with a 5% interest.

You can start with a small contribution to your emergency funds to get you going. However, most financial advisors recommend having savings of at least three months’ worth of your monthly expenses to cover unforeseen events like unemployment. The ideal amount would be to cover 6 months.

Your budget will tell you how much you need to have in your emergency fund.

Middle term financial goals

Now that you have to pay your debt and establish your emergency fund is time to work on your middle term goals! At this time, you plan, for example, buying a house, having a baby. Go after your dreams. You can make a career change or plan on upgrading your education, starting a business.

Decide what goal you should be after at this stage and determine how much money you’ll need to accomplish it and start taking steps towards achieving it.

Always remember that goals should be time-bound. Break them down into smaller steps, so you don’t get overwhelmed, just like the steps described to paying the debt.

Financial advisors recommend adding life insurance at this stage. Planning for the unexpected can help your family in case something happens. I have to check this on my end.

Long term financial goals

The biggest financial goal at this stage is about retiring. If you start investing and saving earlier in life, you will be ahead of the race. To help you plan for retirement, start by determining how much money.

When I started working, the company I was working for hired a financial advisor. He met each of us individually to set our investment portfolio based on our personal goals. I can’t forget his face when I told him I was planning on retire at 40. He must have had thought I was crazy or had lost my mind. I lost faith in him.

The time to accomplish your financial goals depends on you and your commitment to achieving them.

You might want to join the movement F.I.R.E(Financial Independence Retire Early). I am on Fire, are you? This philosophy aims to minimize expenses and maximize investment and savings, allowing you to retire earlier.

As a final word

There is nothing set in stone when it comes to setting goals. We have been talking in this post about what is common sense among financial advisors. The truth is you are in charge of all this.

Do not get discouraged if you miss a goal or take you longer than anticipated to keep going.

It’s a good practice to revise your financial plan every year to update your new priorities and review your progress. Don not be hard on yourself and now and then reward yourself for your accomplishment. Remember, we change as we experience life, and accordingly, your financial plan should change.

Let me know what step you will take first. Paying your debt or creating an emergency fund?

These money-saving apps will help you cut out expenses. Go to the Save Money section for more tips on how to save money.

They should teach this stuff in Highschool! So many young people just don’t learn it until later in life. Good post! 👍🏻

Thank you, Jan!