Urray!!! So you have decided to become a homeowner as soon as possible. You have made a great decision !! I want to help you reach your goal. Let me share with you how to save money for a house in 6 months. It worked for me; I am pretty sure it will work for you too.

- How much to save for a house calculator

- Should you put 5% or 20% down?

- 1. You will need a budget.

- 2. Cut all unnecessary expenses.

- 3. Automate your finances

- 4. Decide where to put your saved money.

- 5. Do not think of taking big risks during this time.

- 6. Make extra money

- 7. Consider the home buyers incentive program.

- Conclusion

How much to save for a house calculator

The first thing you should do is determine how much house you need to save for a house given a specific selling price.

Use the following calculator to determine how much money you need to save for a house. Fill in the field purchasing price and the percentage of the price you want as a downpayment. You can play with both values to see how much you will need to save realistically based on your comfort level.

Know that you know how much you need to save; it is a good idea to determine if you can actually afford the house.

It would be better if you get a pre-approval at this point so you know for sure how much money you can borrow. If you prefer, you can use This calculator from CMHC can help you determine if you can afford the house based on your family combined income and your monthly expenses. You have the ultimate word here, but some guide doesn’t hurt.

Let’s take a look at an example. Imagine you can afford a $600k house. You will have to look at different scenarios to determine what monthly payments you feel comfortable with and how much debt you are willing to carry on.

The 20% of 600k is 120k, whereas the 5% is 30k. Based on your pre-approval, you will know if you can get away with the 5%, or you have to come up with the 20%.

Keep in mind that you need to cover expenses to close your purchase, like lawyer fees, land transfer, and home appraisal.

Should you put 5% or 20% down?

It depends. If you are in Canada in one of the heated real estate markets, you shouldn’t wait to have the 20 percent down. By the time you have saved 120k, your 600k house will be worth 800k, and your 20 percent won’t be enough anymore.

I wouldn’t wait. In fact, I didn’t wait to have 20 percent for my first house and bought it with 5 percent down. Best decision ever. That’s why I am showing you how to save for a house in 6 months.

What is CMHC insurance, and how does it affect your savings

On the other hand, If you can come up with 20%, you won’t have to pay the CMHC insurance, which will save you a ton of money in the long run.

When you give less than a 20% downpayment in Canada, you need to add an insurance premium to your mortgage. This is known as The CMHC Mortgage Loan Insurance premium. The insurance cost will be included in your mortgage, and it will reflect on your monthly payments.

How much insurance premium you will pay depends on your downpayment size, and it is calculated as a percentage of the loan. The higher the percentage of the total house price/value you borrow, the higher the percentage you will pay in insurance premiums. Take a look at the table to see current percentages.

| Loan-to-Value | Premium on Total Loan | Premium on Increase to Loan Amount for Portability |

| Up to and including 65% | 0.60% | 0.60% |

| Up to and including 75% | 1.70% | 5.90% |

| Up to and including 80% | 2.40% | 6.05% |

| Up to and including 85% | 2.80% | 6.20% |

| Up to and including 90% | 3.10% | 6.25% |

| Up to and including 95% | 4.00% | 6.30% |

However, everything comes down to numbers, and they don’t lie. Run your numbers, and they will tell you what’s the best approach for you and your unique situation.

Finally, when you have a clear picture of how much money you need to save for a house, you can start following these steps on how to do it in 6 months.

1. You will need a budget.

Suppose you don’t like the word budget, like me. You might call it something else, but you will have to become your money private detective and find out every move it does once it hits your account.

There are several methods to start budgeting. You can use an application like Mint that connects to your bank account, and it helps you with classifying and tracking your expenses all under the same room.

Or you can do it manually with my budget planner that you can download for free. Whatever you prefer, you will need to track your money. Therefore a budget will help you in your money-saving goal.

That task to save money for a house in 6 months is not easy, but I will show you how. You can do it!.

2. Cut all unnecessary expenses.

Now that you know where your money is going; you need to cut as many expenses as you can. Think in terms of 6 months, how many little expenses can add up.?

Can you live without TV? Chances are you do. Pause your cable contract for the next six months, and you can save a good 800 dollars by doing just that. Besides, you don’t have to give up watching tv; you can watch free tv.

Consider downgrading your cell phone plan for the next six months. A 25 basic plan would work well temporarily. If you are paying $120, that’s a potential saving of $570 over the 6-month term.

I never said it was going to be easy. I told you it could be possible.

Don’t cut out your Tim Hortons. That’s not worthy and won’t make a significant contribution to your saving. You keep enjoying your coffee but limit your night outs for dinner and parties. Think of this moment as an extraordinary time where you have a goal to achieve.

These 10 money-saving apps will come in handy to reduce some expenses. They will be your best allies to save money for your house in 6 months.

3. Automate your finances

If you bank online, you can set up automatic monthly payments to be withdrawn from your checking account directly to the savings. This way, you won’t even know that you had the money in the first place, and you won’t be tempted to expend it.

Don’t worry if you don’t know how to do it. You can request a meeting with your bank financial advisor, and they will be happy to assist you in automating your savings.

It would help if you let them know your goals; they can disclose current promotions and help you reach your saving goals sooner.

4. Decide where to put your saved money.

Depending on where you deposit your money, your savings can have an extra boost.

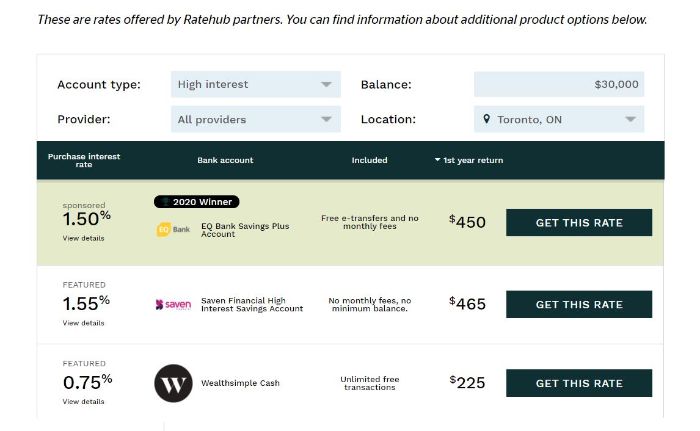

According to Bankrate, with a high yield savings account, you can earn up to a 1.5 percent return on your savings every month in some institutions. And in a $30 000 balance, you can make up to $465. It is not a huge amount, but it is free money towards your savings. Just check with your bank first. They might have similar or better options.

What is the Home Buyer’s Plan and how to use it for your downpayment?

If you are a first-time homebuyer, you can take advantage of the federal government Home Buyers’ Plan. In other words, you are a first-time home buyer if you didn’t occupy a home that you owned or one that your current life partner owned in the previous 4 years to submit your application for the Home Buyers’ Plan.

What is the Home Buyers’ Plan? This government incentive allows you to borrow up to $35000 from your RRSP savings. To clarify, you can combine with your couple and borrow up to $70000 to help you finance the downpayment of the house you will be buying or building.

Consequently, you get to borrow the money tax-free, provided that you repay it within a 15-year period.

Be aware that the funds you will be using must be in your RRSP account for at least 90 days previous to withdrawal and approval. You also need to apply to demonstrate that you qualify for the program.

Advantages of the Home Buyers’ Plan for your saving plan.

This strategy is a steppingstone in our guide on how to save for a house in 6 months because this program will help you reduce the time of savings due to its significant advantages. As a result, you to save for your downpayment in the record time of 6 months.

For example, you have already been saving for your retirement; you can access those funds to add them to your downpayment. As a result, you can save the full 20% downpayment and avoid paying insurance premiums.

On the other hand, the money your borrow will count as a tax deduction the year you buy your house. You can use any tax refund you receive towards your downpayment or your closing cost.

Don’t have an RRSP? This is a good time to open one. As a first-time homebuyer, this will help tremendously. Ask your personal financial advisor about it.

5. Do not think of taking big risks during this time.

If you feel tempted to invest in any business venture that would promise you to make big money, think twice. Six months is not enough for a business to generate significant profits or at least a guaranteed return. So play it low and remember what you are saving for. Therefore, don’t lose track of your goals and save money for your house in 6 months.

6. Make extra money

This is the most crucial step in saving money for a house in 6 months. As such, it would be best if you maximize your earnings.!! And the sooner you start, the better.

Maybe it is time to start looking for another job. Remember, these six months are a test of your abilities to go beyond your comfort zone.

For example, this couple pays for their mortgage flipping furniture. You could do that as well to add up to your downpayment savings.

You will find many resources to increase earnings to your house downpayment in my make money section.

7. Consider the home buyers incentive program.

Here is the government again helping you become a homeowner. The First-Time Home Buyer Incentive will help you save for your house sooner. Why? The government will lend you money to buy your house. In exchange, they will share the equity of your house with you.

By the time you decide to sell the house, if you ever do, you will repay the government loan based on a percentage of the property’s equity, whether up or down.

Consequently, you may not have to save as much of a down payment to afford the payments associated with the mortgage. The effect of the larger down payment is a smaller mortgage and, ultimately, lower monthly costs.

After all, you have 25 years to repay the incentive or sooner if you sell the house or want to pay it, whichever comes first.

Conclusion

To summarize, let’s recap how to save money for a house in 6 months. First, determine how much you will need to save. Then, create a budget and start cutting expenses. Afterward, decide where you will put your money, so it grows the most. Are you going to use a high yield savings account or your RRSP?. Lastly, consider taking advantage of the programs the government offers to help you save for your house.

Have fun saving for your house, my friend!!

Disclaimer: The opinions expressed in this article are mine only. I am not a personal finance advisor; please read my disclaimer page. Before attempting to do any of the strategies here, consult your advisor. I share my experience with the best of intentions, but I do not take any responsibilities if they don’t work for you.

You may also like:

Very informative information. I actually just refinanced after buying last year.