Are you looking for a safe and reliable way to send money? Chace Money Orders are a great option! They’re easy to fill out and can be used to send money across the country or even internationally. In this post, I’ll show you step-by-step how to fill out a Chase Money Order so you can send your money with confidence.

Let’s get started!

How to Fill Out a Chase Money Order Step by Step

Filling out a Chase money order is a simple process that involves a few easy steps. Here is a guide on how to fill out a money order:

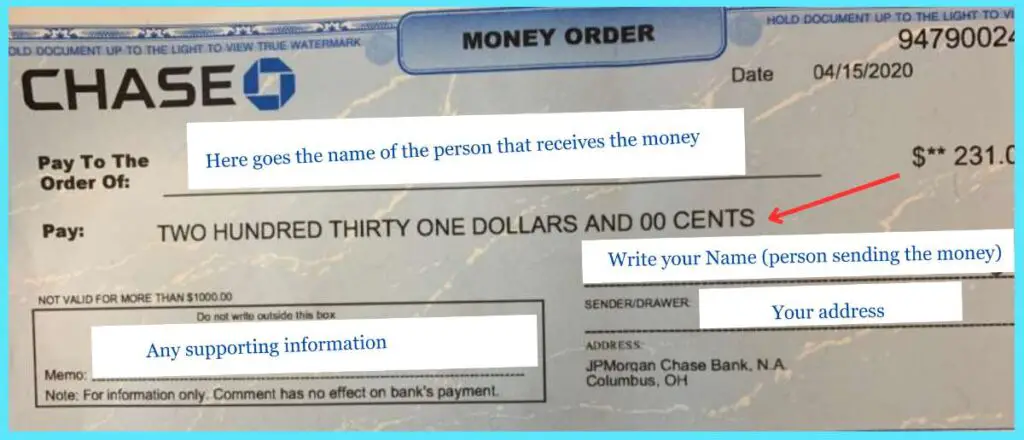

- Check the amount – Before filling out the money order, make sure the amount is correct. The issuer prints the amount in numbers and writes it out in words on the front, just like they would be on a personal check. If the amount is incorrect, point it out to the clerk who issued it.

- Write the recipient’s name – Write the name of the person or business that will receive the money order on the line that starts with “Pay to the Order Of.” Make sure to spell the name correctly to avoid any issues.

- Write your name and address – On the line that says “From,” write your name and address. This will help the recipient know who sent the money order.

- Include any additional information – If there is a memo or notes section on the money order, you can include additional information about the purpose of the money order. For example, if you are paying rent, you can write “rent” in the memo section.

- Sign the money order – Sign the bottom of the front of the money order. This certifies that the money order is ready to be cashed out.

- Keep the receipt – After you have filled out the money order, keep the receipt for your records. The receipt will include important information such as the money order number, date, and amount.

- Purchase the money order – To purchase a money order, you will need a form of payment. Some issuers limit the amount of the money order, so make sure to check with the issuer beforehand.

By following these simple steps, you can easily fill out a Chase money order and send it to your recipient.

Retaining the Receipt

When you purchase a Chase money order, it’s important to keep the receipt that comes with it.

The receipt serves as proof of purchase and contains important information that you may need in the future.

Here are a few reasons why retaining the receipt is essential:

Proof of Purchase

The receipt is proof that you purchased the money order.

It shows the date of purchase, the amount of the money order, and the payment method used.

If you need to dispute a payment or track down a lost or stolen money order, the receipt will be your proof of purchase.

Tracking Number

The receipt also contains a tracking number that you can use to track the money order.

This number is unique to your transaction and can be used to confirm that the money order was cashed or to track its delivery status.

If you lose the money order, the tracking number can help you locate it.

Copy of the Money Order

The receipt also includes a copy of the money order. This copy shows the same information that is on the original money order, including the payee’s name, the amount, and the date.

If you lose the original money order, you can use the copy to track it down or request a refund.

Keep the Receipt Safe

To ensure that you have access to the information on the receipt when you need it, it’s important to keep it in a safe place.

Consider storing it with your important documents or in a fireproof safe. If you need to access the information on the receipt, you’ll be glad you kept it safe.

In essence, your Chace Money Order receipt serves as proof of purchase, contains a tracking number, and includes a copy of the money order.

Where to Purchase a Chase Money Order

If you need to purchase a Chase money order, you can do so at any Chase Bank branch.

Chase Bank is a popular financial institution that has branches all over the United States.

You can also purchase a Chase money order online through their official website.

If you prefer to purchase a money order from a different financial institution, you can do so at various banks and credit unions.

TD Bank and Wells Fargo are examples of banks where you can purchase a money order.

In addition to banks, you can also purchase money orders at convenience stores, grocery stores, and retailers such as Walmart and supermarkets.

Western Union is another popular option for purchasing money orders.

When purchasing a money order, make sure to bring cash or a debit card.

Some issuers may also accept credit cards, but it’s best to check beforehand to avoid any issues.

You will also need to provide the recipient’s name and the amount you want to send.

It’s important to note that when purchasing a money order from a third-party issuer, there may be additional fees.

These fees can vary depending on the issuer and the amount of the money order.

Make sure to read the terms and conditions carefully before making your purchase.

How to Purchase a Money Order

If you need to send money through the mail or to someone who doesn’t have a bank account, a money order can be a good option.

Chase Bank offers money orders to its customers. Here’s how to purchase a money order from Chase:

- Visit a Chase branch: You can purchase a money order from any Chase branch. Locate the nearest branch to you by using the Chase branch locator.

- Bring the necessary information: You’ll need to know the name of the payee and the payment amount. If you have an account number or billing account number, bring that information as well.

- Bring payment: You can purchase a money order with cash, a debit card, or a Chase checking or savings account. Credit cards are not accepted.

- Pay the fee: Chase charges a small fee for each money order. The fee varies by location, but it’s typically around $5.

- Fill out the money order: Once you’ve purchased the money order, you’ll need to fill it out. Follow the instructions on the money order and make sure you fill in all the required information, including the payee’s name and your name and address.

- Keep your receipt: It’s important to keep your receipt in case there are any issues with the money order. If the money order is lost or stolen, you’ll need the receipt to get a refund or cancel the money order.

Depositing or Cashing a Money Order

After you have correctly filled out your Chase money order, you may need to deposit or cash a money order.

Here are some options for depositing or cashing your money order:

- Banks and Credit Unions: If you have a bank account, you can deposit your money order into your account. Simply bring your money order and a valid ID to your bank or credit union. Some banks may place a hold on the funds until the money order clears, so be sure to ask about any hold times.

- Check-Cashing Businesses: Check-cashing businesses can also cash your money order for a fee. These fees can vary depending on the business, so be sure to ask about the fees before cashing your money order.

- United States Postal Service: If your money order was purchased from the United States Postal Service (USPS), you can cash it at any USPS location. You will need to bring a valid ID and pay a small fee to cash your money order.

When depositing or cashing your money order, be sure to endorse it on the back.

This means signing your name on the back of the money order in the designated endorsement area.

If you are depositing the money order, you may also need to write your account number on the back of the money order.

It’s important to note that if your money order is lost or stolen, you may be able to get a refund or replacement.

However, you will need to have the original money order receipt and be able to provide proof of purchase.

Contact the issuer of your money order for more information on their refund and replacement policies.

Overall, depositing or cashing a money order is a straightforward process.

Just be sure to bring a valid ID and have the necessary funds to pay any fees associated with the transaction.

Safety Measures and Mistakes to Avoid

When filling out a Chase money order, it is essential to take certain safety measures and avoid common mistakes to ensure that your transaction goes smoothly and securely. Here are some tips to help you fill out your Chase money order safely and accurately:

- Fill out the money order legibly: Make sure to write legibly and clearly on the money order to avoid any confusion or errors. Illegible handwriting can cause delays and even lead to the money order being rejected.

- Ensure accuracy: Double-check all the details you’ve filled out on the money order, such as the recipient’s name and address, to ensure that they are accurate. Any errors can result in the money order being returned or even lost.

- Be aware of insufficient funds: Before filling out a money order, make sure that you have sufficient funds to cover the amount you are sending. If the money order bounces due to insufficient funds, you may be charged a fee, and the recipient may not receive the funds.

- Beware of scams and fraud: Be cautious of any unsolicited requests for money orders, especially if they are asking for personal information or claiming that you have won a prize. Such requests could be a scam, and you may end up losing money.

- Avoid common mistakes: Some common mistakes to avoid when filling out a money order include using incorrect information, not signing the money order, or failing to include the correct fee. These mistakes can result in delays or even cancellation of the transaction.

These measures will ensure your Chase money order transaction is safe, accurate, and hassle-free.

Frequently Asked Questions

What is the proper way to fill out a money order?

When filling out a money order, it is important to follow the instructions carefully and legibly. You should provide the recipient’s name, the amount of money, and your name and address. Make sure to use a pen with black or blue ink and avoid making any mistakes or corrections. If you are unsure about how to fill out a money order, you can refer to the instructions on the money order or contact the issuer for assistance.

How do I fill out a Chase money order?

To fill out a Chase money order, you will need to provide the following information:

- Pay to the order of: Write the name of the person or business that you are giving the money order to.

- Amount: Write the amount of money you are giving.

- Purchaser’s address: Write your address.

- Purchaser’s signature: Sign the money order.

Make sure to double-check all the information before submitting the money order.

Does Chase money order require a signature?

Yes, a Chase money order requires a signature from the purchaser. You should sign the money order in the purchaser’s signature section.

Who should I make the money order payable to?

When filling out a Chase money order, you should make it payable to the person or business that you are giving the money order to. Make sure to write the recipient’s name clearly and accurately.

How do I fill out the remitter section on a money order?

The remitter section on a money order is optional. If you want to include your name and address as the purchaser, you can fill out this section. Otherwise, you can leave it blank.

Can I cash a Chase money order at any bank?

Chase money orders can be cashed at any Chase bank location. If you do not have a Chase account, you may need to provide identification and pay a fee to cash the money order. Other banks may also accept Chase money orders, but you should check with the bank first to confirm their policy.