If you are serious about your finances, you know you need to start tracking your expenses. Although there are many ways to record your expenses, there is nothing more convenient than apps that keep track of spending.

Tracking money is a relatively straightforward process. You can try to do it manually and write down each transaction you make. However, there are more efficient, more precise ways to do it, and that is with a mobile app.

This post will give you 9 alternatives you can use to empower your wallet and start spending like a pro.

Why you should Keep Track of your expending

There are many reasons to track your expending, but the obvious one is that You can’t spend more than what you have!.

If you don’t know how much you’re spending on things like groceries or gas, it will be easy for you to overspend because you won’t realize that you’ve spent too much until after you pay for everything.

Tracking your expenses will help you know exactly how much money you spent on each item.

It will also help you determine spending patterns you are unaware of and correct them, eventually saving you money.

You will be able to compare the previous month’s expenses and see how you have been progressing or not.

Eventually, you will be able to make better financial decisions based on the spending habits and data you will be collecting.

But in the end, you will be able to save a ton of time by having a single place to check your expenses.

How Does an Apps that keep track of spending work?

An app that keeps track of spending will offer several features. These apps give you insight into your spending habits.

They can help you pay off your debt, show your progress, track your investment, and so much more.

Most of them require you to link your bank accounts and credit cards to track all your expenses from the same place.

How Much Does an App that keep track of spending Cost?

You can find free expenses trackers apps. But in most cases, you need to pay for extra features like credit score monitoring.

Prices vary from app to app. You can find prices ranging from a monthly fee of $16.99 to $84 per year.

You are also likely to get a 30 days money-back guarantee which will allow you to test the app and see if it is a good match for you.

Is an App to Keep track of Spending Worth it?

Whether or not an expense tracker app is worth it will depend entirely on your situation.

You can try a free version first and decide later if you will use the app. Then as you get used to tracking your expenses, you can add the extra features as you need them.

If the app saves you more than its cost, it may be worth the investment.

1.Mint- most popular app that keep track of spending

It is the most popular personal finance app. It supports many banks and lenders so that you won’t have a problem connecting your accounts.

Mint app will help you track your spending and manage all your finances in one place. They will find opportunities for you to save more.

Additionally, you get to check for free your credit score.

The app is not perfect. You can find bugs, and it can be time-consuming if you have a lot of daily transactions. That is why Mint is best suited for beginners or users that don’t have many daily transactions.

2.Moka

The app rounds up purchases to the nearest dollar and deposits them into a user’s Moka account. It’s a great way to start saving money without feeling like you’re depriving yourself.

Besides helping you track your spending, the Moka app automatically offers exciting features to watch your money grow on autopilot.

Moka app was previously Mylo who rebranded to expand to other markets. This app is only available in Canada and France.

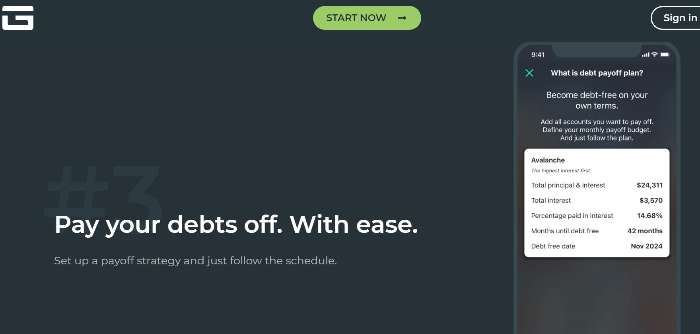

3.PocketGuard

PocketGuard has handy features that will help manage your money. From creating your budget and staying accountable.

You should link your bank account for better results. But is not required to use the app.

My Pocket is among their best features, which shows how much you have left for daily expenditures.

You can track all your transactions and categorize them. You can see all your transactions back until the day the PocketGuard was created in 2014.

Create spending limits and get insides into what you spend with spending categories called pockets. Or find where you could pay less on your bills with the app help.

This app makes it a breeze to set goals to save or pay off debt. It also helps you maximize your saving by finding heading opportunities like lowering your bills, getting rebates on purchases, or canceling hidden subscriptions.

4.Goodbudget

Goodbudget is a budgeting app that will help you track your spending. It uses the envelope system to categorize your spending. Which is a simple concept that is proven to help organize your finances.

As you spend daily, you can only take money from the envelope of that category. Let’s say you have groceries, eating out, or kid money.

Once you have spent all the money on one envelope, you shouldn’t spend on that category anymore until you recharge again on the next paycheck.

This method will save you a lot of money if you are consciously following the rule and sticking to your budget limits.

The app is available on iPhone, Android, and online. It has a 4.7-star review on the App Store and 4.4 Google Play.

It is a simple-to-use system that will help you stay below your spending limit.

5.Mvelopes

This budgeting and expense tracking app offers a spending forecast and gives you suggestions to keep you from exiting your spending limits on your next shopping trip.

In the same way, your budget using envelopes; you will put cash on your on each digital envelope and the beginning of the month. You can spend until you run out of money on the particular envelop.

This app has access to over 16000 financial institutions, so you will likely find yours. You can import your bank and credit card accounts and track all expenses from the Mvelopes app.

6.Monefy

Monefy allows synchronizing data between devices using your google account safely. Track your expenses on your phone or tablet so the whole family can track their expenses together.

There is a set of default categories if you don’t know where to start, which you can modify to your liking.

Monefy has an excellent review of 4.6, with over 170k people giving their thoughts o the app.

It is easy to use and can help you manage your spending successfully.

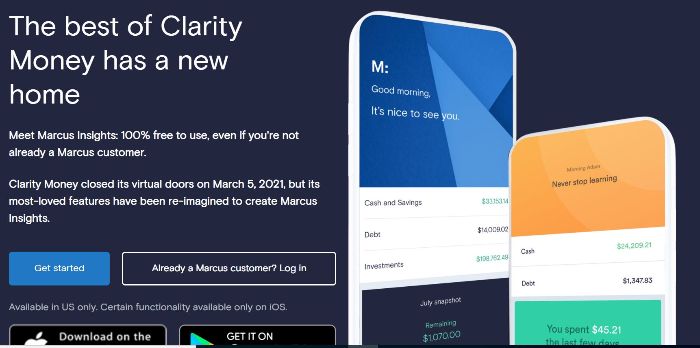

7.Claritymoney

Claritymoney is a neet and easy-to-use app that keeps track of spending. Although you can access it on your computer as well, the app interface is way better.

This app will track your expenses, and you can link it with a variety of accounts. Having all your transactions under one roof goes a long way toward managing your personal finances.

One cool feature is that you can track your credit score and stay vigilant. It also lets you automatize your savings. If you are paying for subscriptions you don’t use; the app will find those for you.

8.Quickbooks

This app is a powerful tool to keep your world organized.

If you have a side hustle or a small business, you know how messy and overwhelming it can get to separate your personal finance from your company.

It effortlessly manages all that chaos.

Quickbook will have made most of the heavy lifting for you when you need to report your taxes.

Tracking expenses, managing your business contracts, bills, and cash flow are why QuickBooks stands out.

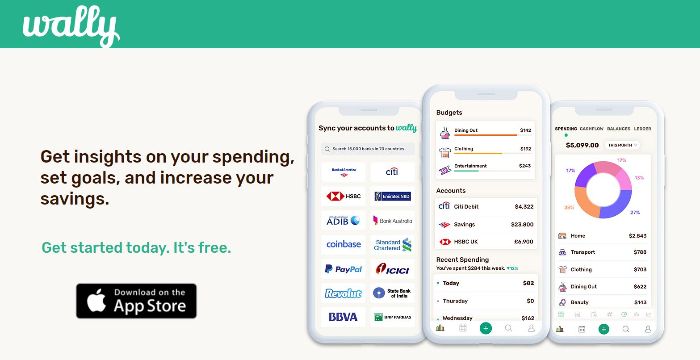

9.Wally

Wally is an expense tracker that is perfect for those with shared expenses.

It uses artificial intelligence to decode your spending habits after you have synced your financial accounts. You are giving great insight on your expending, which eventually you can mitigate by taking action.

It is only available on the App Store. It is not perfect, but it will do its job.

Final thoughts on Apps that keep track of spending.

There you have 9 Apps that keep track of spending. I am confident you will find here your perfect app.

Give it a go and start tracking your spending. You will find that it will be easier for you to keep true to your financial goals. Any help you can get is worth your time if it takes you closer to your goals.