Have you ever found a check lying around and wondered if you could cash it? Maybe it was a check from a friend or family member that you forgot to cash. Or maybe it was a check that you found on the street.

Whatever the case may be, it can be confusing to know what to do when you find a check. In this blog post, we’ll explore the different scenarios in which you might find a check and provide some guidance on what to do next.

So, if you’ve ever asked yourself, “Can I cash it?” keep reading to find out!

- Understanding Checks

- Can I Deposit a Check That Isn't in My Name?

- What should I do if I suspect a check I found may be stolen?

- What should I do if I found a check that isn't mine?

- What are the risks of cashing a check that I found?

- How can I verify if a check is legitimate before cashing it?

- How to Cash a Check

- Cashing a Check from a Friend or Family Member

- Fees and Charges Involved cashing a check

- Dealing with Old or Voided Checks

- Alternative Methods to Cash a Check

- Last Thoughts

Understanding Checks

If you’ve found a check, you’re probably wondering if you can cash it. Before doing so, it’s important to understand the different parts of a check. And how these parts relate to you as the potential holder of the check.

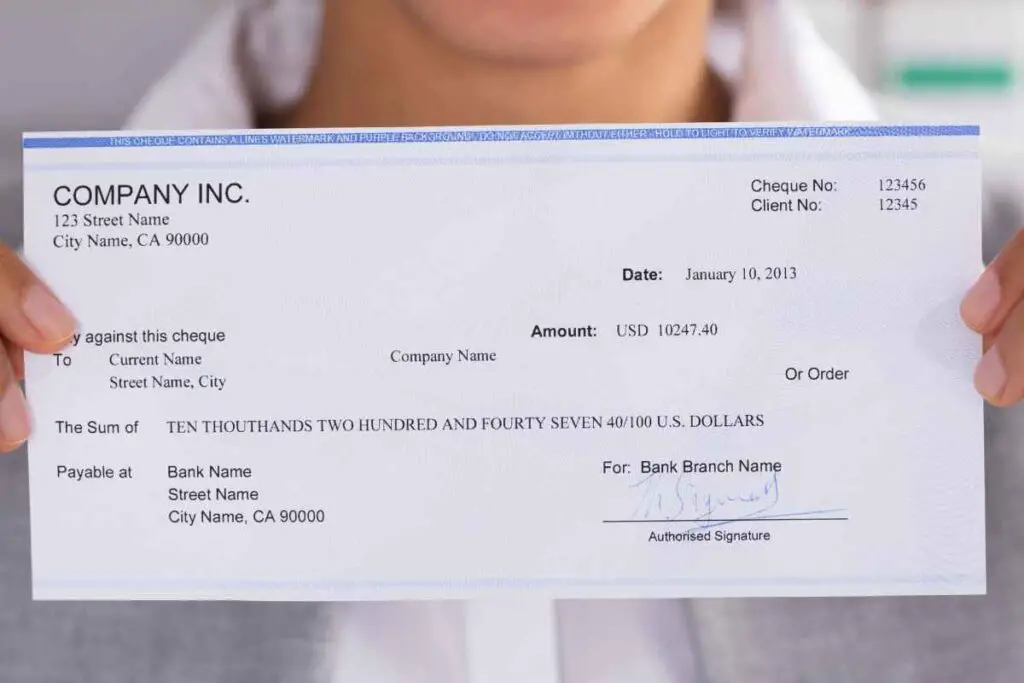

What is a Check?

A check is a written order to a bank to pay a specific amount of money from the account of the check writer to the person or entity named on the check.

When you receive a check, you become the holder of the check. This means you have the right to deposit or cash the check.

Parts of a Check

Here are the different parts of a check and what they mean:

- Payee: The person or entity that the check is made payable to.

- Amount: The amount of money that the check is for, both in numerical and written form.

- Date: The date that someone wrote the check.

- Signature: The signature of the check writer, which authorizes the bank to pay the check.

- Memo: Optional information that the check writer can include to indicate the purpose of the payment.

Uniform Commercial Code

The Uniform Commercial Code (UCC) is a set of laws that govern commercial transactions, including checks.

The UCC provides guidelines for how everybody should handle checks. This includes the responsibilities of the check writer, the bank, and the holder of the check.

Cashing a Check

To cash a check, you will typically need to provide identification to the bank, such as a driver’s license or passport.

The bank may also require you to endorse the check by signing the back of it.

If the check writer has put a stop payment on the check or if the account has insufficient funds, the bank won’t cash the check.

In these cases, the bank may charge you a fee for attempting to cash a bad check.

Can I Deposit a Check That Isn’t in My Name?

If you have a check that isn’t in your name, you may wonder if you can still deposit it.

The simple answer is that it depends on your bank’s or credit union’s rules.

Some institutions may allow you to deposit a check that isn’t in your name. Others may require that the original payee endorse the check.

That means that you need to know the persons who own the check.

If you have your own account with the bank, you may be able to deposit the check into your account. However, you may need to provide additional documentation.

For example, you might need a power of attorney or a letter of authorization to prove that you have the right to deposit the check.

If you try to deposit a check that isn’t in your name and the bank or credit union discovers that you are not the intended recipient, you could face legal consequences.

It’s always best to be upfront with the bank. Ask them about their policies before attempting to deposit a check that isn’t in your name.

In some cases, you may be able to have the payee endorse the check over to you. This means that the payee signs the back of the check and writes “Pay to the order of [your name]” on the back.

This endorsement transfers the rights to the check to you, allowing you to deposit it into your account.

What should I do if I suspect a check I found may be stolen?

If you suspect that a check you found may be stolen, it’s important to take the right steps to protect yourself and others.

Here are some steps you can take:

Contact the bank that issued the check. They can verify if the check is legitimate or not. Ask them if they have any information about the check. Is it reported as lost or stolen?

If you believe the check is stolen, contact the police immediately. They can investigate the matter and help you return the check to its rightful owner. Also, file a report with the police, which can be helpful if any further issues arise.

Do Not Cash the Check. Cashing a stolen check is illegal. You could be liable for any damages that result from cashing it.

Protect Your Identity. If you found the check in a public place, it’s possible that someone intentionally left it there to see if someone would cash it. If you do cash a stolen check, you could be putting your own identity at risk. Be cautious about sharing your personal information with anyone who asks for it.

Be a Good Samaritan. Do the right thing and try to return it to its rightful owner. You can contact the bank that issued the check or turn it into the police. By doing so, you’ll be helping to prevent fraud and protect others from financial harm.

It’s important to take action to protect yourself and others.

By following these steps, you can help prevent fraud and ensure that the check returns to its rightful owner.

What should I do if I found a check that isn’t mine?

Finding a check that isn’t yours can be a bit confusing and stressful. However, there are a few steps you can take to ensure that you handle the situation properly.

Firstly, do not attempt to cash the check if it is not yours. It is illegal to cash a check that is not yours, and doing so can result in legal consequences.

Instead, you should try to return the check to its rightful owner.

If you find the check in a public place, such as a parking lot or sidewalk, you can try to turn it into the local authorities.

They may be able to help locate the owner of the check and return it to them.

If you know the person to whom the check belongs, you can try to contact them directly.

You can use social media, email, or phone to reach out to them and let them know that you found their check.

If you are unable to locate the owner of the check, you can try to return it to the bank that issued it.

They may be able to help locate the owner of the check and return it to them.

In any case, it is important to keep a record of your efforts to return the check to its rightful owner. This can help protect you in case any legal issues arise.

It is important to handle the situation with integrity and honesty. Trying to cash a check that is not yours can result in serious legal consequences, so it is always best to try to return the check to its rightful owner.

What are the risks of cashing a check that I found?

There are significant risks involved in cashing a check that you found, including:

- Legal consequences: Cashing a check that you found is illegal and considered theft. You could face criminal charges, fines, and even jail time.

- Fraudulent checks: The check you found could be a fraudulent check, which means it’s fake and won’t clear. If you cash a fraudulent check, you could be responsible for the money. As a result, the bank can freese your account.

- Stolen checks: The check you found could be a stolen check, which means it was taken from someone else’s account without their permission. If you cash a stolen check, you could be held responsible for the money you received, and you could face criminal charges.

- Identity theft: If you found a check with someone else’s name on it, you could be committing identity theft by cashing it. Identity theft is a serious crime that can result in severe legal and financial consequences.

Cashing a check that you found is not worth the risk. It’s illegal, and you could face severe legal and financial consequences.

If you find a check, the best thing to do is to try and return it to the rightful owner or contact the bank that issued the check.

How can I verify if a check is legitimate before cashing it?

Before cashing a check, it is important to verify its legitimacy to avoid any potential scams or bounced checks.

Here are some steps you can take to verify if a check is legitimate:

- Contact the bank that the check is drawn on and ask them to verify if the check is legitimate and if there are sufficient funds to cover it. You can find the bank’s contact information on the check itself or by searching online. Be sure to have the check’s routing number, account number, and check number handy when you call.

- Legitimate checks often have security features such as watermarks, microprinting, and special inks that are difficult to replicate. You can hold the check-up to the light to see if there are any watermarks or use a magnifying glass to check for microprinting. You can also check if the ink changes colour or appears raised when you run your finger over it.

- Make sure that the date on the check is current and that it has been signed by the issuer. If the check is post-dated or has not been signed, it may not be legitimate.

- Double-check that the amount written on the check matches the amount that you are supposed to receive. If the amount is different, it may be a mistake or a sign of a scam.

- There are professional check verification services that can help you spot potential bad checks. These services can verify the check’s authenticity, check for sufficient funds, and provide you with a guarantee that the check will clear. However, these services may charge a fee for their services.

By taking these steps to verify a check’s legitimacy, you can help protect yourself from potential scams and ensure that you receive the funds that you are owed.

How to Cash a Check

So, you found a check, and you want to cash it. Great! Here’s what you need to know.

Endorse the check

The first step is to endorse the check. This means signing your name on the back of the check. Therefore, make sure you sign it exactly as your name appears on the front of the check.

If you’re cashing the check with someone else, they’ll need to endorse it too.

Choose Where to Cash the Check

You have a few options when it comes to cashing a check. You can go to the bank that issued the check, your own bank, or a check-cashing store.

Some retail stores also offer check-cashing services.

Check with Your Bank or Credit Union.

One of the most common places to cash a check is at a bank or credit union. If you have an account with a bank or credit union, you can deposit the check into your account and withdraw the funds.

Some banks place a hold on the funds for a few days, so make sure you ask about any hold policies.

If you don’t have an account, you can still cash the check at the bank or credit union, but you may be charged a fee.

Retail and Grocery Stores

Many retail and grocery stores offer check-cashing services. Walmart and Kroger are two examples of stores that offer this service.

You can usually cash a check at these stores for a fee. Some stores may also require you to have a membership or a certain type of ID to cash a check.

Consider Online Options

If you don’t want to go to a physical location to cash your check, you can also cash it online.

Some banks offer mobile deposit options, where you can take a picture of the check and deposit it through their app.

You can also use third-party apps like PayPal, Venmo, Wisely or Cash App to deposit and cash checks.

Bring Proper ID

No matter where you go to cash your check, make sure, you bring proper identification with you.

This can include a driver’s license, passport, or state ID.

Some places require a second form of ID, like a credit card or utility bill.

Fees and Limits

Be aware that there may be fees for cashing a check, especially if you use a check-cashing store. More on fees in the next section.

That’s it! With these tips, you should be able to successfully cash your check and get your money.

Cashing a Check from a Friend or Family Member

If you found a check from a friend or family member, you might wonder if you can cash it. The answer is yes, but there are a few things you need to consider before you do so.

First, you need to make sure that the check is signed by the person who wrote it and that it is not post-dated.

Post-dated checks have a future date on them, and you cannot cash them until that date.

If the check is post-dated, you will need to wait until the date on the check before you can cash it.

Second, you need to make sure that you have the proper identification to cash the check.

Most banks and check cashing places require a valid government-issued ID, such as a driver’s license or passport.

Make sure that your ID is current and matches the name on the check.

Third, you need to be aware of any fees associated with cashing the check. Some banks and check cashing places charge a fee to cash a check if you do not have an account with them.

Make sure that you are aware of any fees before you cash the check so that you are not surprised by any unexpected charges.

Finally, you need to make sure that you are not breaking any laws by cashing the check. If the check is stolen or fraudulent, you could face legal consequences for cashing it.

Make sure that you trust the person who wrote the check and that you have a good reason to believe that the check is legitimate.

Fees and Charges Involved cashing a check

When it comes to cashing a check, there are fees and charges involved that you need to be aware of. These fees can vary depending on where you go to cash your check, how much the check is for, and whether or not you have an account with the bank or credit union.

Check Cashing Fees

If you don’t have a bank account, you may need to use a check cashing service to cash your check.

These services charge a fee for their services, which can range from a flat fee to a percentage of the check amount.

For example, Walmart charges $3 to cash checks of $1,000 or less or $6 for checks of over $1,000 to $5,000.

Overdraft Fees

If you deposit a check into your bank account and it bounces, you could pay an overdraft fee.

This fee can be as high as $35 or more per transaction, depending on your bank.

To avoid overdraft fees, make sure the check is valid and has sufficient funds before depositing it.

Account Fees

If you don’t have a bank account and need to cash checks regularly, it may be worth opening a checking account to avoid check cashing fees.

Some banks offer free checking accounts with no monthly fees, while others may require a minimum balance or charge a monthly fee.

Be sure to read the fine print and understand any fees associated with the account before opening it.

Mobile Check Deposit Fees

Many banks now offer mobile check deposit, which allows you to deposit a check using your smartphone or tablet.

While this can be a convenient option, some banks may charge a fee for this service.

Be sure to check with your bank to see if there are any fees to deposit checks using their mobile application.

Dealing with Old or Voided Checks

If you’ve found an old check or one that has been voided, you may be wondering if you can still cash it.

Here’s what you need to know:

Old Checks

Banks typically have a policy on how long they will accept checks for after they have been signed.

This period varies depending on several factors, including the type of check and the bank’s policies.

For example, payroll checks are usually valid for 90 or 180 days, with 180 days being the most common.

If the check specifies a limitation like this, the bank will honour it and won’t cash the check if you’re beyond that period.

However, if the check doesn’t have any expiration date or limitation, then the bank can choose not to honour it if it’s older than six months.

Many businesses tend to put a length of time on the check for accounting purposes.

For example, business checks may contain statements such as “Must void after 90 days” or “Not valid after 180 days.”

Voided Checks

If you have a voided check, it’s not possible to cash it.

A voided check means that it has been cancelled and is no longer valid.

Voiding a check is a common practice when you make a mistake while writing it, such as writing the wrong amount or payee.

If you have a voided check, you should shred it or destroy it to ensure that no one else can use it.

What to Do with Old Checks

If you have an old check that is still valid, you can deposit it into your bank account or cash it at the bank.

Whether or not the check is still valid, you can contact the issuer or your bank to confirm.

If you have a voided check, you should destroy it to prevent anyone else from using it.

Alternative Methods to Cash a Check

If you don’t have a bank account and need to cash a check. Fortunately, there are alternative methods you can use.

Prepaid Debit Cards

One option is to use a prepaid debit card. You can purchase these cards at many retailers and can use them to deposit checks, as well as make purchases and withdraw cash.

Some popular prepaid debit cards include:

- Bluebird by American Express

- Walmart MoneyCard

- Netspend Visa Prepaid Card

To deposit your check, simply follow the instructions provided by your prepaid debit card provider.

You may be able to deposit your check using your mobile device or by visiting a participating retailer.

Check-Cashing Services

Another option is to use a check-cashing service. These services specialize in cashing checks and may be able to cash your check even if you don’t have a bank account.

Some popular check-cashing services include:

- ACE Cash Express

- Check Into Cash

- Moneytree

Before using a check-cashing service, be sure to check their fees and requirements.

Many check-cashing services charge a fee for their services. They also may require you to provide identification and other information.

Rewards Programs

Finally, some retailers offer rewards programs that allow you to earn cash back when you cash a check.

For example, Walmart offers a program called Cash-Back Rewards that allows you to earn up to $75 in cash back each year when you cash your checks at Walmart.

To take advantage of these programs, simply sign up and follow the instructions provided by the retailer.

Be sure to read the terms and conditions carefully, as there may be limits on the amount of cash back you can earn.

Last Thoughts

Finding a check can be exciting, but it’s important to handle it properly. Before attempting to cash the check, make sure it is valid and not stolen.

If you are unsure, contact the issuer to verify its authenticity.

If the check is valid and belongs to you, you can cash it at your bank or a check-cashing store. Keep in mind that fees may apply, so it’s important to read the terms and conditions carefully.

Some banks may require a hold on the funds. So be ready to wait a few days before accessing the money.

If the check is not under your name, you may need to obtain a signature from the payee or have them endorse the check over to you.

This process can be complicated. So it’s best to consult with your bank or a financial advisor.

Remember, cashing a check that doesn’t belong to you or that you know is stolen is illegal and can result in serious consequences.

Always act with integrity and follow the proper procedures to avoid any legal issues.